|

| Risk Management | Alkhadim LLC |

Don’t worry and go for risk management audit services. Hire any professional and dedicated audit firm in UAE and leave your stress.

Every business organization has to face risks. There are various sources from which risks can be originated. These sources include financial market uncertainty, Project failure threat, the risk from a natural disaster, credit risk, uncertain circumstances or events, legal liabilities, etc. Certain risks are necessary for the future growth of the organization. Risk management service offered by Audit firms in UAE will recognize these risks in advance and besides that, they will take precautionary steps after analyzing them. Risk management in terms of Audit Firms in Dubai is identifying and analyzing risks in financial statements before making any decision. In simple words, risk management is the continuous reviewing of the organization to determine the processes that are providing harm to your organization. For ensuring the success and growth of the business, it must be capable to assess and manage risks.

Why Risk Management and assessment is required?

There has been a lot of business failures recently and the collapse of large organizations. The economic challenges prevailing currently are also one such factor that demands revision of risk profile at regular intervals. As the conditions in market changes, risk also changes. Hence there arise a need to reflect such changes in risk profile. But certain organizations do not make any adjustments in risk profiles. Such organizations are helped by audit firms in Dubai in risk assessment and prioritizing them so that the well-being of an organization is affected.

The number of incorporations in Dubai is increasing because a lot of opportunities and offers are given by the government. As a result audit firms in Dubai are also increasing. More and more businessmen and investors are ready to set up in Dubai to avail the advantages offered by the government. As a result, competition is increasing and further, there is an increase in risks to businesses. This creates the need for Audit firms in UAE for adopting risk management practices. It will keep up the performance and efficiency of the organization.

What will the experts of Audit Firms in UAE do?

Their main focus is on the assessment of risk portfolios, and lay emphasis on the enhancement of business performance. Not only this, to meet internal and external expectations, they will frame the risk strategy, establish governance and culture in an organization. They will find a suitable remedy for different risk issues. Audit firms in Dubai will reduce compliant costs and introduce measures related to new compliances. They will assess the risk management capabilities of the organization. The experts employed by Audit firms in UAE will reduce cost and add value by transforming risk management functions. They also develop tools that will handle compliance issues and provide a report on financial risks by continuously measuring and monitoring them. They also take care of corporate treasury functions. The strategies to avoid risks are not only framed rather executed properly using the expertise of auditors appointed by audit firms in the UAE. Besides managing corporate treasury, they provide accounting support, hedging governance and ongoing valuation services.

How Risk Management by Audit Firms in Dubai will benefit the organization?

|

| Benefits of Risk Management | Alkhadim LLC |

Benefits of risk management are many. There is a need to create awareness among business owners. Risk assessment and management are two significant functions that every organization must carry out for future growth and success. If business risks are not assessed timely and actions are not taken to manage such risks, a business may fail. Those business owners, who think that risk assessment audit leads to extra cost, they should know that it will save future cost and time of the organization.

• The reputation of your business will improve

• Any potential business risk harming your business will be identified timely through risk management

• There will be saving in time and cost to the organization

• Resources of the organization will be saved

• Risks can be avoided in the future based on past experiences

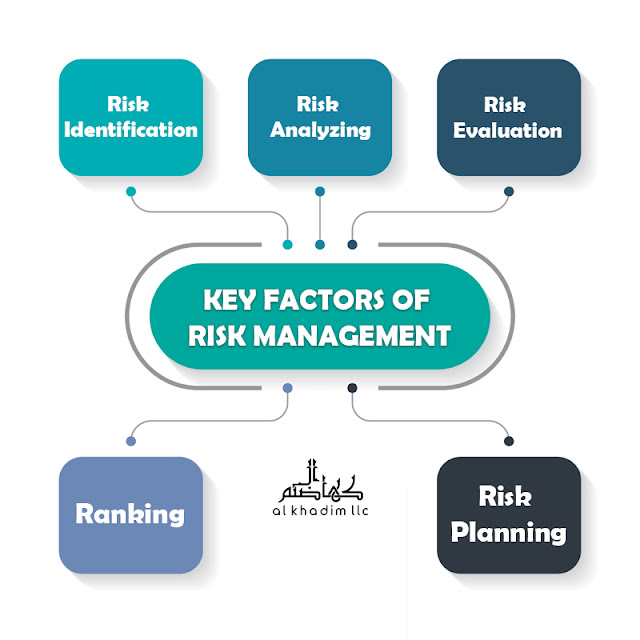

Understand the risk management services provided by Audit firms in UAE

Audit firms in Dubai will perform risk management services for your business. What they will do? Let’s discuss:

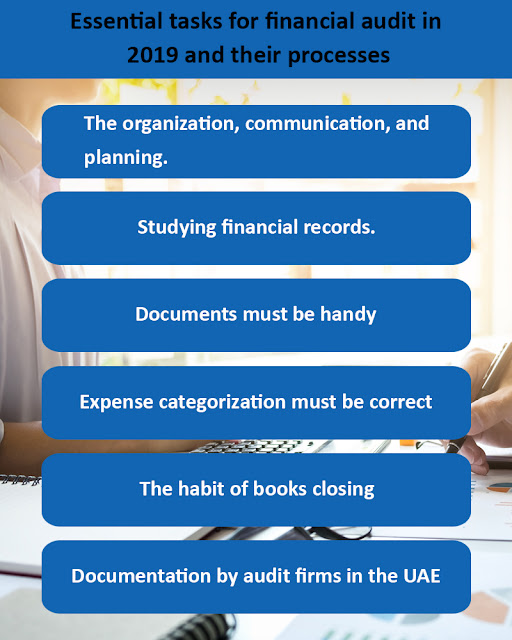

|

| Key Factors of Risk Management | Alkhadim LLC |

Risk identification

Firstly, they will identify risk affecting the working of the organization. The risk identification is done through a deep study of the organization and having a discussion with the staff. The risks that are affecting the reputation of the business and harming your business needs to be concentrate first.

Risk Analyzing

After risk identification, Audit firms in Dubai will go for risk analyzing. It includes determining the consequences of risks by understanding their nature. Their impact on the goals and objectives of the company will also be studied in detail.

Risk evaluation and ranking

Risk evaluation and ranking by audit firms in the UAE will help in prioritizing them. It will help in determining the seriousness of risks and take timely actions.

Risk planning

In this step, auditors at audit firms in Dubai will make plans in response to risks identified. Plans will be according to highest to modest ranked risks. There will be plans to prevent risks, mitigate them and for contingency situations.

Monitoring and reviewing

The risks will be monitored and reviewed by audit firms in Dubai continuously so that they do not get repeated in the future. They may also guide the management to ensure compliance of internal controls to avoid the occurrence of risks again.

How to prepare a risk management plan?

Who will prepare a risk management plan?? Audit firms in UAE will frame the best plan for your business to mitigate the risks. The risk management plan will determine the risks prevailing, study its impacts and take necessary measures to handle them. Let’s discuss how risk management plan is framed by audit firms in Dubai:

• The risks identified will be recorded in risk registers. A detailed list of all risks will be maintained.

• The level and impact of risks will be analyzed. A measure should be set for timely analyzing the risk before it’s too late to take action.

• The team of audit firms in UAE will do the deep study of the risks and identify the triggers that will work for those risks to be controlled.

• The next step is finding the right solution where the team of the audit firms in Dubai will come together to do detailed discussions. They need to take collective action against those risks otherwise it will harm the organization.

• After finding a collective solution, a plan is framed by audit firms in UAE where all risks will be documented with respective solutions to use them in the future.

• After framing an effective plan, risk registers will be monitored and reviewed regularly so that changes can be implemented according to changes in circumstances.

Risk management types

There are various types of risk management managed by audit firms in UAE that are discussed one by one:

1. Enterprise risk management

2. Quantitative risk management

3. Market risk management

4. Bank and Currency risk management

5. Credit risk management

6. Operational and Financial risk management

7. Software and IT risk management

8. Technology risk management

9. Project risk management

10. Integrated risk management

11. Commodity risk management

Techniques or Strategies of risk management

Risk management and assessment need certain strategies so that their reoccurrence can be prevented. This is done by audit firms in Dubai. They are responsible for implementing strategies that will not only assess risk but will reduce their impacts. The risk register is prepared that needs to be revised at regular intervals and that will be used for future reference. Following are the techniques that will manage risks prevailing in the organization:

Risk avoidance

Risk should be avoided to the maximum extent in order to manage it. Business can avoid risky situations or activities that carry any kind of risk.

Mitigation of risk

Risk can also be managed by mitigating or reducing it. The effort is made on reducing the negative impact of risk audit firms in Dubai are trying to mitigate.

Transfer of risk

Risk can also be managed by transferring it away

Acceptance of Risk

Certain risk level is accepted by every organization provided profitability is more than its potential risk level.

Risk management and assessment are the essentials of every organization without which business may get fail. Risks provide great harm to the organization. Hence, it is necessary to keep the organization away from such a threat.